When it comes to traveling, ensuring you have the right insurance coverage is crucial. In this article, we delve into the world of “OK to Travel” insurance, shedding light on its unique offerings and why it’s a must-have for any trip.

Get ready to explore the ins and outs of this specialized insurance option that can save you from unexpected travel woes.

Let’s start by understanding what “OK to Travel” insurance is and how it sets itself apart from standard travel insurance policies.

What is Travel Insurance?

Travel insurance is a type of insurance designed to cover unexpected events that may occur during a trip. It provides protection against financial losses and offers assistance in emergencies while traveling.

Types of Coverage

- Medical Expenses: Covers medical treatment, hospital stays, and emergency medical evacuation.

- Trip Cancellation/Interruption: Reimburses non-refundable expenses if the trip is canceled or cut short due to covered reasons.

- Baggage Loss/Delay: Provides compensation for lost, stolen, or delayed luggage.

- Travel Delay: Covers additional expenses incurred due to delayed flights or other travel disruptions.

Benefits of Travel Insurance

-

Medical Emergencies:

In the event of an illness or injury while traveling, travel insurance can cover medical expenses that may otherwise be costly.

-

Trip Cancellation:

If unforeseen circumstances force you to cancel your trip, travel insurance can help recover non-refundable expenses.

-

Lost Luggage:

Travel insurance can provide reimbursement for lost, stolen, or damaged baggage, easing the financial burden of replacing belongings.

Importance of Travel Insurance

Travel insurance is essential when planning a trip to mitigate risks and uncertainties that may arise. It offers peace of mind knowing that you are financially protected in case of emergencies, ensuring a smoother travel experience overall.

Understanding “OK to Travel” Insurance

When it comes to travel insurance, “OK to Travel” insurance offers a specific type of coverage that is different from regular travel insurance policies. This type of insurance is designed for individuals who have pre-existing medical conditions that may affect their ability to travel.

Benefits and Coverage Options

- “OK to Travel” insurance provides coverage for pre-existing medical conditions, which may not be covered under a standard travel insurance policy.

- This type of insurance offers emergency medical coverage, trip cancellation protection, and coverage for lost or delayed baggage.

- It may also include coverage for medical evacuation in case of a medical emergency while traveling.

Necessity of “OK to Travel” Insurance

There are situations where “OK to Travel” insurance might be necessary or recommended:

- Individuals with pre-existing medical conditions that could affect their ability to travel may require this specialized coverage.

- Travelers who have had recent medical treatments or surgeries may benefit from the additional coverage provided by “OK to Travel” insurance.

- For those who want peace of mind knowing that they are covered in case their pre-existing medical condition flares up during their trip, this insurance can be essential.

Eligibility and Requirements

When it comes to purchasing “OK to Travel” insurance, there are specific criteria and requirements that need to be met in order to qualify for this type of coverage.

Eligibility Criteria

- Typically, individuals who are deemed fit to travel by their healthcare provider are eligible for “OK to Travel” insurance.

- Age restrictions may apply, with some policies only available to travelers within a certain age range.

Specific Requirements

- Documentation from a medical professional stating that the individual is fit to travel may be required.

- Pre-existing medical conditions may need to be disclosed during the application process.

Restrictions and Limitations

- Some insurance providers may have restrictions on the duration of the trip or the destinations covered under “OK to Travel” insurance.

- Certain high-risk activities or extreme sports may not be covered by this type of insurance.

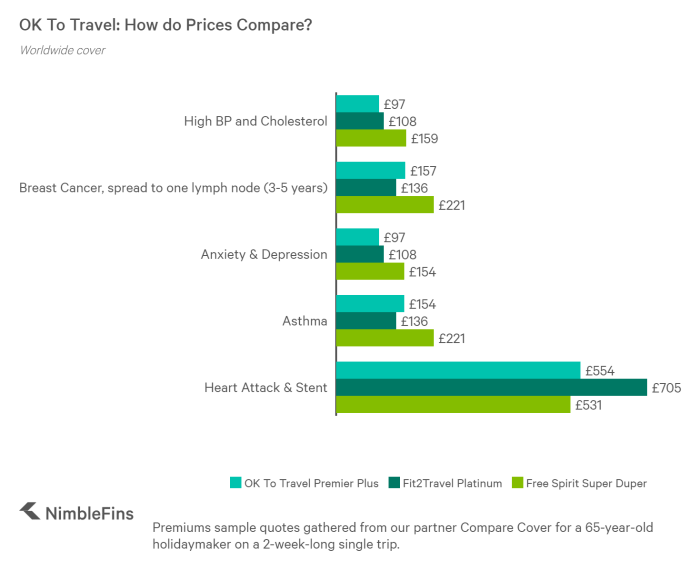

Comparing “OK to Travel” Insurance Providers

When it comes to choosing an “OK to Travel” insurance provider, it’s essential to compare different options to find the best coverage for your needs. Here, we will discuss the coverage, benefits, costs, and customer reviews of various insurance providers offering “OK to Travel” insurance.

Allianz Global Assistance

- Provides comprehensive coverage for trip cancellations, medical emergencies, and lost baggage.

- Offers 24/7 customer support and assistance services.

- Cost varies depending on the level of coverage selected.

Travel Guard

- Offers tailored insurance plans for different types of travelers.

- Coverage includes trip cancellations, emergency medical assistance, and travel delays.

- Cost-effective options available for budget-conscious travelers.

AXA Assistance USA

- Provides coverage for medical emergencies, trip interruptions, and baggage loss.

- Offers customizable plans to suit individual travel needs.

- Positive customer reviews praising the ease of filing claims and efficient customer service.

Final Conclusion

In conclusion, “OK to Travel” insurance emerges as a valuable asset for travelers seeking peace of mind and protection on their journeys. With its tailored benefits and flexible coverage options, this type of insurance ensures you can travel worry-free, knowing you’re prepared for any unforeseen circumstances that may arise.

Ensure your next adventure is safeguarded with “OK to Travel” insurance.

Detailed FAQs

What is the purpose of “OK to Travel” insurance?

“OK to Travel” insurance provides coverage for pre-existing medical conditions, allowing travelers with health issues to embark on their trips with peace of mind.

How does “OK to Travel” insurance differ from regular travel insurance?

“OK to Travel” insurance specifically caters to individuals with pre-existing health conditions, offering coverage that standard travel insurance policies may not provide.

What are the eligibility criteria for purchasing “OK to Travel” insurance?

To be eligible for “OK to Travel” insurance, travelers must disclose their pre-existing medical conditions and provide relevant medical documentation.