Delve into the realm of average health insurance cost, where a myriad of factors come into play to determine the financial burden on individuals. From age to lifestyle choices, this topic unveils a complex web of influences that shape insurance premiums.

Let’s embark on a journey to unravel the mysteries surrounding health insurance costs.

As we navigate through the intricacies of regional differences, historical trends, and cost-lowering strategies, a clearer picture emerges of the dynamic landscape of health insurance expenses.

Factors Affecting Average Health Insurance Cost

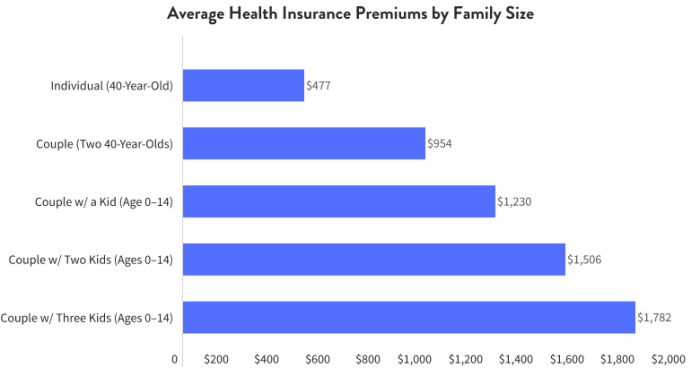

When determining the average cost of health insurance, several factors come into play that can significantly impact the final premium amount. Let’s delve into some of the key factors that influence health insurance costs.

Age, Location, Coverage Level, and Pre-existing Conditions

- Age: Younger individuals typically pay lower premiums compared to older individuals due to the lower likelihood of developing serious health conditions.

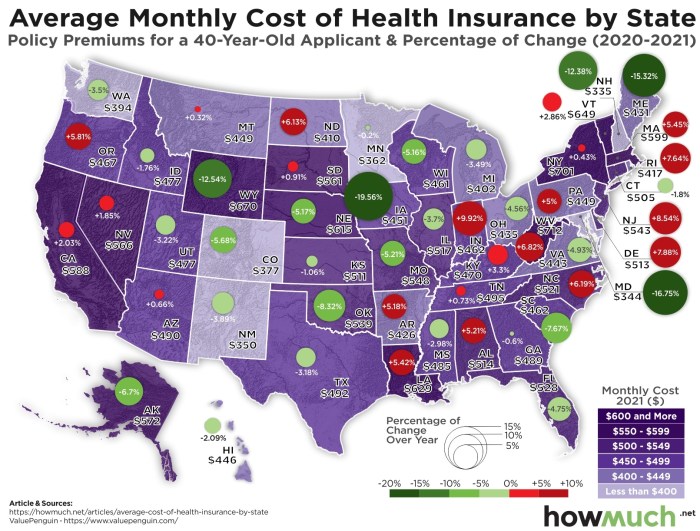

- Location: Health insurance costs can vary based on where you live, with some regions having higher healthcare costs than others.

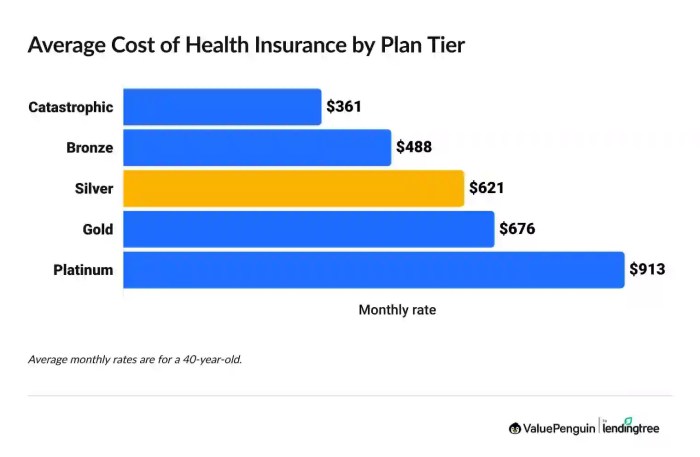

- Coverage Level: The extent of coverage you choose, such as basic coverage or comprehensive coverage, will affect the cost of your health insurance.

- Pre-existing Conditions: Individuals with pre-existing medical conditions may face higher premiums or exclusions from certain coverage options.

Role of Lifestyle Choices

Your lifestyle choices can also impact your health insurance premiums. For example:

- Smoking: Tobacco users often face higher insurance premiums due to the increased health risks associated with smoking.

- Exercise Habits: Maintaining a healthy lifestyle through regular exercise and proper nutrition may lead to lower insurance costs as it can reduce the likelihood of developing chronic conditions.

Type of Plan

The type of health insurance plan you select can also affect the average cost:

- HMOs (Health Maintenance Organizations): HMOs typically have lower premiums but require you to choose a primary care physician and get referrals for specialists.

- PPOs (Preferred Provider Organizations): PPOs offer more flexibility in choosing healthcare providers but generally come with higher premiums.

- High-Deductible Plans: Plans with high deductibles usually have lower premiums but require you to pay more out-of-pocket before insurance coverage kicks in.

Regional Disparities in Health Insurance Costs

Health insurance costs can vary significantly across different regions or states in the US due to various factors such as population density, healthcare provider availability, and state regulations.

Average Health Insurance Costs Across Urban and Rural Areas

Urban areas generally have higher health insurance premium rates compared to rural areas. This can be attributed to the higher cost of living, greater demand for healthcare services, and more extensive network of healthcare providers in urban settings.

Impact of Healthcare Provider Availability on Insurance Costs

The availability of healthcare providers in a specific region can greatly influence insurance costs. Areas with limited healthcare provider options may have higher insurance premiums due to increased demand for services and lack of competition among providers.

Trends in Average Health Insurance Costs

Over the past decade, there have been noticeable trends in the average cost of health insurance, influenced by various economic factors and changes in healthcare policies.

Economic Factors Impacting Insurance Premiums

Historical data shows that economic factors such as inflation and GDP growth play a significant role in the rise or fall of health insurance premiums. When inflation rates are high, insurance companies may increase premiums to cover rising costs. On the other hand, during periods of economic growth, insurance premiums may stabilize or even decrease as more people can afford coverage.

Impact of Healthcare Policy Changes

Recent changes in healthcare policies, such as the implementation of the Affordable Care Act (ACA) in the United States, have had a direct impact on health insurance costs. The ACA introduced regulations that required insurance companies to cover essential health benefits and prohibited them from denying coverage based on pre-existing conditions.

While these changes aimed to make insurance more affordable for individuals, they also led to adjustments in premium pricing to accommodate the expanded coverage.

Strategies to Lower Average Health Insurance Costs

Lowering health insurance costs is a priority for many individuals and families. There are several strategies that can help reduce these expenses and make coverage more affordable.

Utilizing Wellness Programs and Preventive Care

Many health insurance plans offer wellness programs that provide incentives for healthy behaviors such as exercising regularly, eating nutritious foods, and quitting smoking. By actively participating in these programs, individuals can lower their premiums or receive discounts on medical services.

Additionally, taking advantage of preventive care services like annual check-ups, screenings, and vaccinations can help detect health issues early on, preventing costly treatments down the line.

Role of Subsidies or Tax Credits

For low-income individuals, subsidies or tax credits can play a crucial role in reducing the financial burden of health insurance. These financial assistance programs help offset the cost of premiums, making coverage more affordable for those who qualify. It’s important to explore all available options and apply for these subsidies to lower overall expenses.

Negotiating with Insurance Providers and Choosing Higher Deductibles

One strategy to lower health insurance costs is to negotiate with insurance providers for better rates or discounts. Some providers may be willing to offer lower premiums or more comprehensive coverage if approached directly. Additionally, choosing a plan with higher deductibles can result in lower monthly premiums.

While this means paying more out of pocket for medical expenses, it can help reduce overall insurance costs, especially for those who don’t require frequent medical care.

Epilogue

In conclusion, the discussion on average health insurance cost sheds light on the multifaceted nature of this crucial aspect of healthcare. By understanding the factors at play, recognizing regional variations, and staying informed about evolving trends, individuals can make informed decisions to manage their health insurance expenses effectively.

Helpful Answers

What are the key factors influencing average health insurance cost?

Factors such as age, location, coverage level, pre-existing conditions, lifestyle choices, and the type of insurance plan play a significant role in determining health insurance costs.

How do regional disparities impact health insurance costs?

Regional differences can lead to variations in insurance premiums, with urban areas often having higher rates compared to rural areas due to factors like healthcare provider availability.

What trends have been observed in average health insurance costs over the past decade?

Historical data shows fluctuations in insurance costs influenced by economic factors like inflation and GDP growth, along with changes in healthcare policies.

What are some effective strategies to lower average health insurance costs?

Individuals can reduce insurance expenses by utilizing wellness programs, preventive care, subsidies, tax credits, and by negotiating with insurance providers or opting for higher deductibles.