A Comprehensive Guide to Credit Card Comparison

Credit card comparison is a crucial aspect of financial decision-making, shaping the way individuals manage their expenses and maximize rewards. This guide delves into the intricacies of comparing various credit cards, shedding light on key features, types, rewards programs, fees, and credit score considerations.

Let's embark on a journey to unravel the complexities of choosing the right credit card for your needs.

Factors to Consider in Credit Card Comparison

When comparing credit cards, it is essential to consider various factors to ensure you choose the right one that suits your needs and financial goals. Understanding key features such as interest rates, annual fees, rewards, perks, credit limits, foreign transaction fees, and penalties can help you make an informed decision.

Interest Rates

Interest rates play a crucial role in credit card comparison as they determine the cost of borrowing money. Lower interest rates can save you money on finance charges, especially if you carry a balance on your card. It is important to compare both the introductory rates and the ongoing rates to understand the long-term cost of using the card.

Annual Fees

Annual fees are charges imposed by credit card companies for the privilege of using their card. While some cards offer no annual fees, others may have higher fees but come with additional benefits such as rewards or cashback. Consider your spending habits and the value you can derive from the card's perks to determine if the annual fee is worthwhile.

Rewards and Perks

Credit cards often come with rewards programs that allow you to earn points, miles, or cashback on your purchases. Evaluate the types of rewards offered, redemption options, and any bonus categories that align with your spending patterns. Additionally, perks such as travel insurance, concierge services, and purchase protection can add value to your card.

Credit Limits

Credit limits indicate the maximum amount you can borrow on your credit card. Understanding your credit limit is crucial to avoid overspending and potential penalties. Some cards offer higher credit limits based on your creditworthiness, while others may have lower limits but come with lower fees.

Foreign Transaction Fees

If you frequently travel abroad or make purchases in foreign currencies, foreign transaction fees can add up quickly. Look for credit cards that offer no foreign transaction fees to save money on international transactions. Consider the currency conversion rates and additional charges when comparing cards.

Penalties

Penalties such as late payment fees, over-limit fees, and returned payment fees can impact your overall credit card experience. It is essential to understand the penalty structure of each card and how it can affect your finances. Avoiding penalties through timely payments and responsible credit card use is key to maximizing the benefits of your card.

Types of Credit Cards for Comparison

When comparing credit cards, it's important to understand the different types available in the market. Each type offers unique features and benefits tailored to specific consumer needs. Let's explore and compare some of the most common types of credit cards.

Rewards Cards

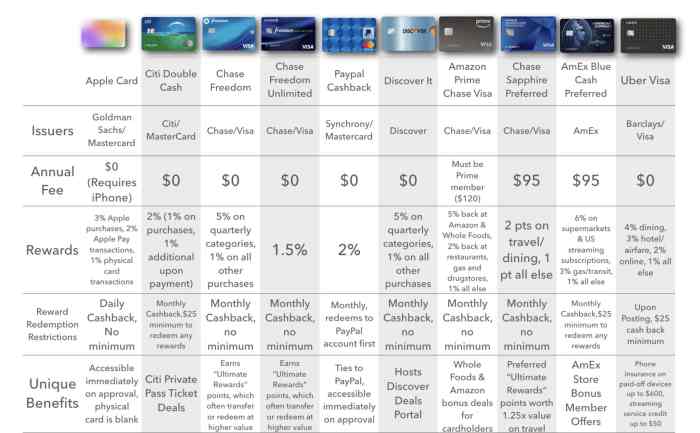

Rewards cards are popular for offering points, miles, or cash back on purchases made with the card. Examples of popular rewards cards include the Chase Sapphire Preferred, American Express Gold Card, and Capital One Venture Rewards Card. These cards are ideal for individuals who frequently make purchases and want to earn rewards for their spending.

However, rewards cards often come with annual fees and higher interest rates.

Cash-Back Cards

Cash-back cards provide a percentage of cash back on purchases made with the card. Some popular cash-back cards include the Citi Double Cash Card, Discover it Cash Back, and Chase Freedom Unlimited. These cards are great for individuals who prefer simplicity and want to earn cash back on everyday purchases.

However, cash-back cards may have limits on the amount of cash back you can earn and may have higher interest rates.

Travel Cards

Travel cards are designed for frequent travelers and offer benefits such as travel rewards, airline miles, and hotel discounts. Examples of popular travel cards include the Capital One Venture Rewards Card, Chase Sapphire Reserve, and American Express Platinum Card. Travel cards are ideal for individuals who travel frequently and want to earn rewards for their travel expenses.

However, travel cards often come with high annual fees and may have restrictions on redeeming rewards.

Secured Cards

Secured cards are a good option for individuals with limited or poor credit history. These cards require a security deposit, which acts as collateral in case of default. Examples of popular secured cards include the Discover it Secured Card, Capital One Secured Mastercard, and Citi Secured Mastercard.

Secured cards are beneficial for individuals looking to build or rebuild their credit. However, secured cards may have higher fees and lower credit limits compared to traditional credit cards.

How to Compare Credit Card Rewards Programs

When comparing credit card rewards programs, it is essential to consider various factors that can impact the overall value you receive. Understanding how to evaluate and compare these programs can help you make an informed decision that aligns with your financial goals and spending habits

Significance of Sign-Up Bonuses, Point Systems, and Redemption Options

- Sign-up Bonuses: Look for credit cards that offer attractive sign-up bonuses, which can provide a significant boost to your rewards balance from the start.

- Point Systems: Evaluate the point system used by each credit card company to understand how points are earned and redeemed. Some cards may offer more flexibility or higher point values for specific categories of spending.

- Redemption Options: Consider the redemption options available for your rewards, such as cash back, travel rewards, gift cards, or merchandise. Choose a card that aligns with your preferences and offers redemption options that are valuable to you.

Annual Fees and Reward Structures Influence

- Annual Fees: Take into account the annual fees associated with each credit card, as they can impact the overall value of the rewards program. Ensure that the benefits and rewards outweigh the cost of the annual fee.

- Reward Structures: Evaluate how rewards are earned and calculate the potential value of the rewards based on your typical spending habits. Some credit cards may offer higher rewards for specific categories, which can be advantageous if they align with your regular expenses.

Comparing Credit Card Fees and Charges

When choosing a credit card, it's crucial to consider not only the rewards programs but also the fees and charges associated with the card. These fees can significantly impact the overall cost of owning and using a credit card. Let's delve into the common fees and charges you should be aware of and how to effectively compare them to find a cost-efficient option.

Common Credit Card Fees

| Fee Type | Description |

|---|---|

| Late Payment Fee | A fee charged when you fail to make the minimum payment by the due date. |

| Balance Transfer Fee | A fee charged for transferring a balance from one credit card to another. |

| Cash Advance Fee | A fee charged for withdrawing cash using your credit card. |

Impact of Fees on Overall Cost

These fees can add up quickly and significantly increase the cost of using a credit card. For example, paying late fees regularly can result in unnecessary expenses that could be avoided with timely payments.

Tips for Effective Comparison

- Compare the fee structures of different credit cards to identify which ones have lower fees or offer waivers under certain conditions.

- Consider your usage patterns to determine which fees you are most likely to incur and choose a card with lower fees in those areas.

- Look for credit cards that offer introductory periods with waived fees to help you save money in the initial months of card ownership.

Credit Score Considerations in Credit Card Comparison

When comparing credit cards, one crucial factor to consider is your credit score. Your credit score plays a significant role in determining the approval process and terms of credit card offers. It reflects your creditworthiness and financial responsibility, influencing the credit limits, interest rates, and rewards you may receive.

Impact of Credit Scores on Credit Card Approval

Your credit score is used by credit card issuers to assess the risk of lending you money. A higher credit score indicates a lower credit risk, making you more likely to be approved for credit cards with favorable terms. On the other hand, a lower credit score may result in higher interest rates, lower credit limits, or even rejection of your application.

Strategies for Individuals with Varying Credit Scores

If you have a high credit score, you have the advantage of qualifying for credit cards with better rewards, lower interest rates, and higher credit limits. On the other hand, individuals with lower credit scores may need to consider secured credit cards or credit-building cards to improve their credit standing before applying for premium credit cards.

Relationship Between Credit Limits, Interest Rates, and Credit Scores

Credit limits and interest rates are closely tied to your credit score. A higher credit score typically leads to higher credit limits and lower interest rates, while a lower credit score may result in lower credit limits and higher interest rates.

It is essential to compare credit card offers based on your credit score to find the best match for your financial situation.

Closure

In conclusion, navigating the realm of credit card comparison demands a keen eye for detail and a thorough understanding of your financial goals. By weighing factors like interest rates, rewards, fees, and credit score implications, you can make an informed decision that aligns with your lifestyle and preferences.

Remember, the right credit card can be a valuable financial tool when chosen wisely.

FAQ Overview

What are the key features to consider when comparing credit cards?

Key features to consider include interest rates, annual fees, rewards, perks, credit limits, foreign transaction fees, and penalties.

How do credit scores impact credit card offers?

Credit scores affect approval processes and terms of credit card offers, influencing credit limits, interest rates, and available rewards.

What types of credit cards are available for comparison?

Types include rewards cards, cash-back cards, travel cards, and secured cards, each offering unique benefits and drawbacks.

What factors should be considered when comparing credit card rewards programs?

Sign-up bonuses, point systems, redemption options, annual fees, and reward structures play a significant role in evaluating rewards programs.

How can one effectively compare credit card fees?

Creating a comparison table for fees like late payment fees, balance transfer fees, and cash advance fees can help in choosing a cost-efficient credit card option.