Unlocking the Potential: A Comprehensive Guide to Mortgage Refinance

Embark on a journey into the world of mortgage refinance, where homeowners can explore opportunities to optimize their financial strategies. From understanding the basics to navigating the complexities, this guide aims to provide clarity and insights for those considering refinancing their mortgage.

Delve into the nuances of different types of refinancing, the essential steps in the process, key factors to weigh, benefits to reap, and challenges to overcome. Whether you're aiming to reduce monthly payments, access equity for home improvements, or consolidate debt, this guide offers a roadmap to help you make informed decisions.

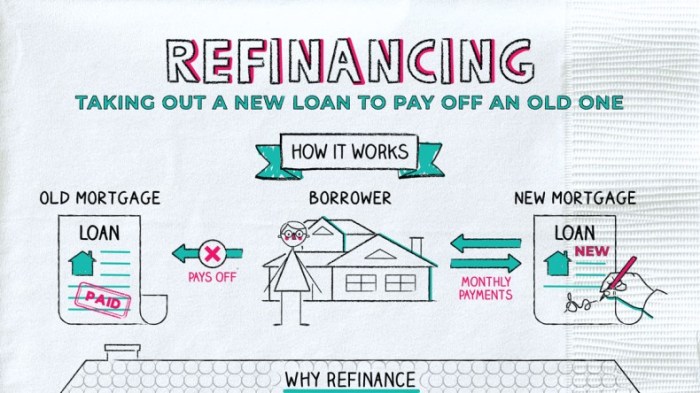

What is Mortgage Refinance?

Mortgage refinance is the process of replacing an existing mortgage with a new loan, typically to take advantage of better terms or rates. This can involve paying off the original loan and starting fresh with a new one, often with different terms, interest rates, or repayment schedules.

Benefits of Mortgage Refinance

There are several situations where mortgage refinance can be beneficial:

- Lower Interest Rates: Refinancing when interest rates are lower can result in significant savings over the life of the loan.

- Shortening Loan Term: Refinancing to a shorter loan term could lead to paying off the mortgage sooner and saving on interest costs.

- Access Equity: Refinancing can allow homeowners to access the equity in their homes for things like home improvements or debt consolidation.

Advantages and Disadvantages of Mortgage Refinance

While mortgage refinance has its benefits, there are also potential drawbacks to consider:

- Advantages:

- Lower Monthly Payments: Refinancing to a lower interest rate can result in reduced monthly payments.

- Consolidate Debt: Combining high-interest debt into the mortgage can result in overall lower interest payments.

- Disadvantages:

- Costs: Refinancing comes with closing costs and fees that need to be factored into the decision.

- Extended Loan Term: Extending the loan term could lead to paying more in interest over time.

Types of Mortgage Refinance

When considering a mortgage refinance, there are different options available to homeowners. Two common types are cash-out refinance and rate-and-term refinance. Let's explore the differences and when each might be suitable.

Cash-Out Refinance

A cash-out refinance allows homeowners to refinance their mortgage for more than they currently owe and receive the difference in cash. This type of refinance is often used to access the equity in a home for purposes such as home improvements, debt consolidation, or other expenses.

It can be a good option when homeowners have built up significant equity in their property and need access to cash for large expenses.

Rate-and-Term Refinance

Rate-and-term refinance, on the other hand, involves refinancing the remaining balance of the mortgage for better loan terms, such as a lower interest rate or a shorter loan term. This type of refinance does not provide cash back to the homeowner but aims to reduce monthly payments, shorten the loan term, or switch from an adjustable-rate mortgage to a fixed-rate mortgage.

Rate-and-term refinance is suitable for homeowners looking to save money on interest over the life of the loan or to pay off their mortgage faster.Overall, the decision between cash-out refinance and rate-and-term refinance depends on the homeowner's financial goals and situation.

Cash-out refinance is ideal for accessing cash for expenses, while rate-and-term refinance is better for saving money on interest or paying off the mortgage sooner.

Process of Mortgage Refinance

Refinancing a mortgage involves several steps that homeowners need to follow to replace their existing loan with a new one. It is essential to understand these steps to navigate through the refinancing process successfully.

Step-by-Step Process of Refinancing a Mortgage

- Evaluate Your Financial Situation: Assess your current financial standing and determine if refinancing is the right choice for you.

- Shop for Lenders: Compare offers from different lenders to find the best refinance deal with favorable terms.

- Submit an Application: Complete the refinance application form and provide the necessary documentation to the lender.

- Underwriting Process: The lender will review your application, credit history, income, and other financial details to determine if you qualify for refinancing.

- Appraisal: A professional appraiser will assess the value of your property to ensure it meets the lender's requirements for refinancing.

- Closing: If approved, you will sign the new loan documents, pay any closing costs, and the old mortgage will be paid off.

Documentation Needed for a Mortgage Refinance Application

- Proof of Income: Recent pay stubs, tax returns, and other income documents.

- Asset Verification: Bank statements, investment account statements, and other asset documentation.

- Credit History: Credit reports from all three major credit bureaus.

- Property Information: Details about the property being refinanced, such as the address and current value.

- Insurance: Proof of homeowner's insurance coverage.

Appraisal and Underwriting in Mortgage Refinance

- Appraisal: An appraisal is an unbiased assessment of the property's value to ensure it meets the lender's requirements for refinancing.

- Underwriting: Underwriters evaluate the borrower's financial profile, credit history, and the property being refinanced to determine the risk level of the new loan.

- Loan Approval: Once the appraisal and underwriting processes are complete, the lender will approve the refinance loan if all requirements are met.

Factors to Consider

When considering mortgage refinance, there are several key factors to keep in mind to make an informed decision. Factors such as credit score, equity in the home, and current interest rates play a significant role in the refinance process.

Credit Score

Your credit score is a crucial factor that lenders consider when you apply for a mortgage refinance. A higher credit score typically means you are more likely to qualify for a lower interest rate. On the other hand, a lower credit score may result in higher interest rates or even denial of the refinance application.

It is important to review your credit score and take steps to improve it before considering a refinance.

Equity in the Home

Equity in your home refers to the difference between the current market value of your property and the amount you owe on your mortgage. The more equity you have, the more options you may have when refinancing. Lenders often offer better terms to borrowers with higher equity as they perceive them as less risky.

It is essential to assess the equity in your home before deciding to refinance.

Interest Rates

Interest rates play a crucial role in determining whether it makes financial sense to refinance your mortgage. If current interest rates are significantly lower than the rate on your existing mortgage, it may be a good time to refinance and potentially save money on monthly payments.

However, it is essential to consider closing costs and how long you plan to stay in the home to determine if the refinance will be beneficial in the long run.

Benefits of Mortgage Refinance

Refinancing a mortgage can offer several potential benefits to homeowners, helping them manage their finances more effectively and achieve their long-term goals.

Lower Monthly Payments or Shorten Loan Term

Refinancing can help lower monthly mortgage payments by securing a lower interest rate than the original loan. This can be especially beneficial if interest rates have decreased since the initial mortgage was taken out. Additionally, homeowners may choose to refinance to shorten the loan term, allowing them to pay off their mortgage faster and save on interest payments over time.

Access Equity for Home Improvements or Debt Consolidation

Another advantage of refinancing is the ability to access equity built up in the home over time. Homeowners can opt for a cash-out refinance, where they borrow more than the remaining balance on their mortgage and receive the difference in cash.

This extra money can be used for home improvements, renovations, or even debt consolidation, consolidating high-interest debts into a single, more manageable loan with a lower interest rate.

Risks and Challenges

When considering mortgage refinance, it is essential to be aware of the potential risks and challenges that may arise. From prepayment penalties to closing costs, there are certain factors to consider before making a decision. Here, we will discuss these risks and challenges in detail.

Prepayment Penalties

Prepayment penalties are fees charged by lenders if you pay off your mortgage earlier than the agreed-upon terms. When refinancing, you may encounter prepayment penalties if you pay off your existing loan before the designated time frame. It is crucial to review your current mortgage agreement to understand if prepayment penalties apply and factor this cost into your decision.

Closing Costs

Another challenge associated with mortgage refinance is the closing costs involved in the process. Closing costs can include fees for appraisal, title search, attorney services, and other administrative expenses. It is important to calculate these costs and determine if the savings from refinancing outweigh the expenses incurred during the closing process.

When Refinancing May Not Be Advisable

Despite the allure of low interest rates, there are situations where refinancing may not be advisable. For example, if you plan to move in the near future or if the cost of refinancing exceeds the potential savings, it may not be the best option for you.

Additionally, if your credit score has significantly decreased since obtaining your original mortgage, you may not qualify for a lower interest rate, making refinancing less beneficial.

Tips for Successful Mortgage Refinance

When it comes to refinancing your mortgage, being prepared and informed can make a significant difference in the outcome. Here are some tips to help you navigate the process successfully and secure the best refinancing terms and rates.

Review Your Credit Score and Credit Report

Before applying for a mortgage refinance, it's essential to review your credit score and credit report. A higher credit score can help you qualify for better interest rates. Make sure to correct any errors on your credit report and work on improving your score if needed.

Shop Around for Lenders

Don't settle for the first offer you receive. Take the time to shop around and compare offers from different lenders. This can help you find the best refinancing terms and rates that suit your financial situation.

Consider Closing Costs

Factor in closing costs when evaluating a refinance. Make sure to understand all the fees involved in the process to determine if refinancing makes financial sense for you. It's important to calculate how long it will take to recoup these costs through your monthly savings.

Choose the Right Loan Term

Decide whether you want to shorten or lengthen your loan term when refinancing. Shorter loan terms typically come with lower interest rates but higher monthly payments. Longer loan terms may offer lower monthly payments but result in more interest paid over the life of the loan.

Consider your financial goals when choosing the loan term that works best for you.

Avoid Taking on Additional Debt

While refinancing can free up some cash, it's important to avoid taking on additional debt during this process. Accumulating more debt can negatively impact your financial stability and increase your risk of default. Focus on managing your existing debt responsibly.

Conclusion

As we reach the end of this journey through mortgage refinance, it's clear that this financial decision holds the power to reshape your homeownership experience. By weighing the pros and cons, understanding the intricacies, and implementing best practices, you can embark on a successful refinancing journey that aligns with your long-term goals.

Empower yourself with knowledge, make informed choices, and unlock the potential that mortgage refinance offers.

FAQ Overview

What is Mortgage Refinance?

Mortgage refinance involves replacing an existing mortgage with a new one, typically to secure better terms or lower interest rates.

When is the right time to consider a cash-out refinance?

A cash-out refinance is suitable when you want to access equity for major expenses like home renovations or debt consolidation.

What documentation is required for a mortgage refinance application?

Documents such as pay stubs, tax returns, and bank statements are commonly needed for a refinance application.

How does credit score impact the mortgage refinance process?

A higher credit score can lead to better refinancing terms and lower interest rates, saving you money in the long run.

What are prepayment penalties in the context of refinancing?

Prepayment penalties are fees charged by lenders if you pay off your mortgage early, which can affect the cost-effectiveness of refinancing.